Avoiding Disaster: The Risks of Insufficient Commercial Insurance Coverage

In the dynamic realm of business, uncertainties lurk around every corner. From unforeseen accidents to legal disputes, entrepreneurs face a myriad of risks that can threaten the very existence of their ventures. Among these uncertainties, having comprehensive commercial insurance coverage is not just prudent—it’s essential. However, the consequences of inadequate coverage are often overlooked, leaving…

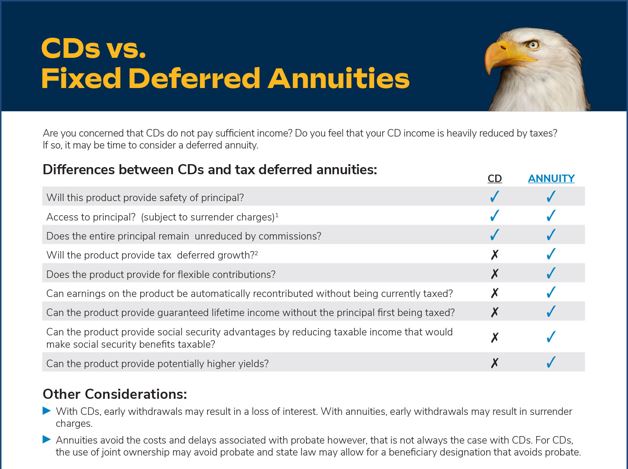

Read MoreUnlocking Financial Security: The Advantage of MYGAs Over Bank CDs

In the realm of financial planning, individuals seek stability, reliability, and growth for their hard-earned money. Among the myriad of investment options available, Multi-Year Guaranteed Annuities (MYGAs) and Bank Certificates of Deposit (CDs) stand out as popular choices. In this blog post, we’ll explore the distinctive advantages of MYGAs over Bank CDs and how the…

Read MoreMaximizing Tax Savings: Why Small Business Owners Should Consider a SEP IRA Before Filing 2023 Taxes

As a small business owner, you wear many hats, from managing operations to overseeing finances. As tax season approaches, it’s crucial to explore opportunities to minimize your tax liability while maximizing retirement savings. One powerful tool at your disposal is the Simplified Employee Pension Individual Retirement Account (SEP IRA). In this post, we’ll delve into…

Read MoreUnderstanding and Navigating Insurance Premium Increases: A Message from the Dan Baze Agency

At the Dan Baze Agency, we pride ourselves on being proactive and transparent in our communication with you. As your trusted insurance partner, it is our responsibility to ensure that you are informed and prepared for any changes that may affect your coverage and finances. In recent times, you might have noticed that insurance premiums…

Read More